Maximize Your Financial Success with Herboth Business Solutions

Click below to claim your offer. We'll then reach out to answer any questions you may have.

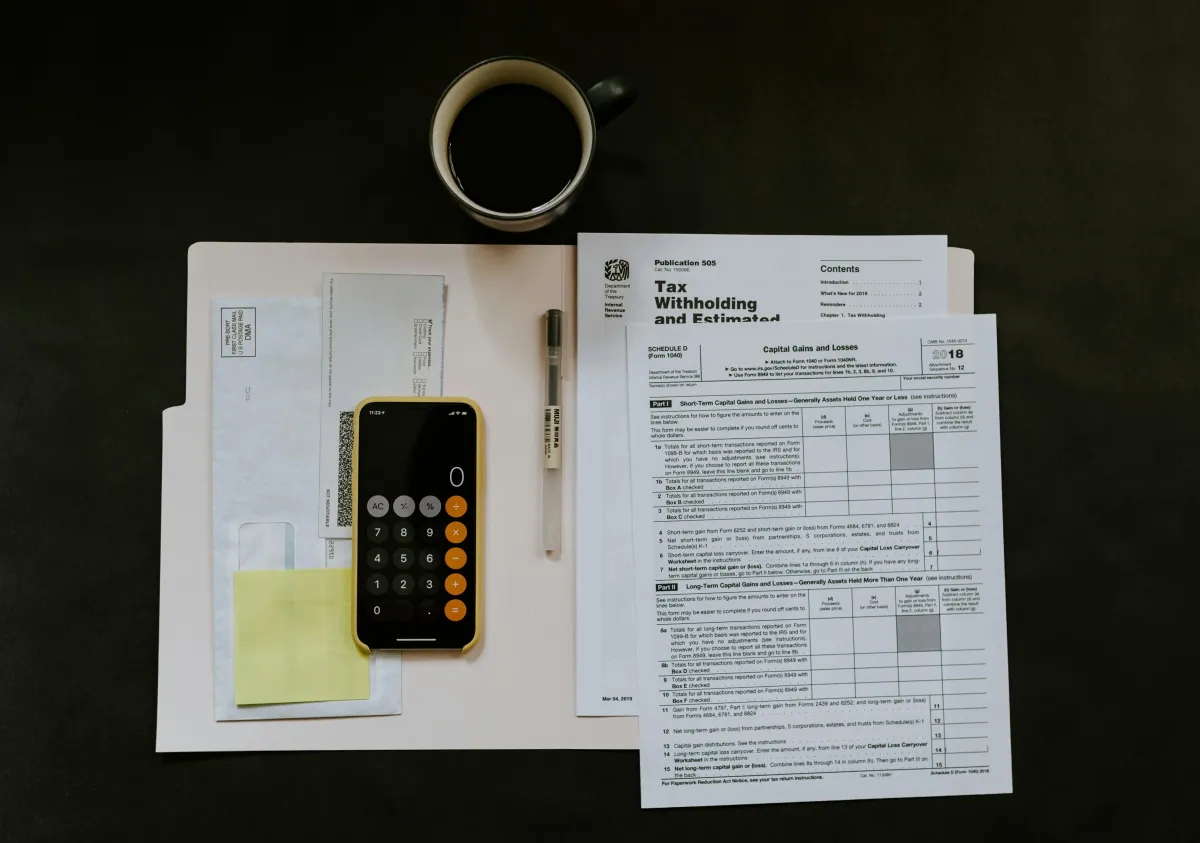

Proud Member of the Jefferson county chamber of commerce

“Helping Small Businesses Thrive Through Financial Clarity”

Helping you Do the money thing right

Our firm specializes in providing comprehensive accounting solutions designed to streamline your financial operations and enhance your business's profitability.

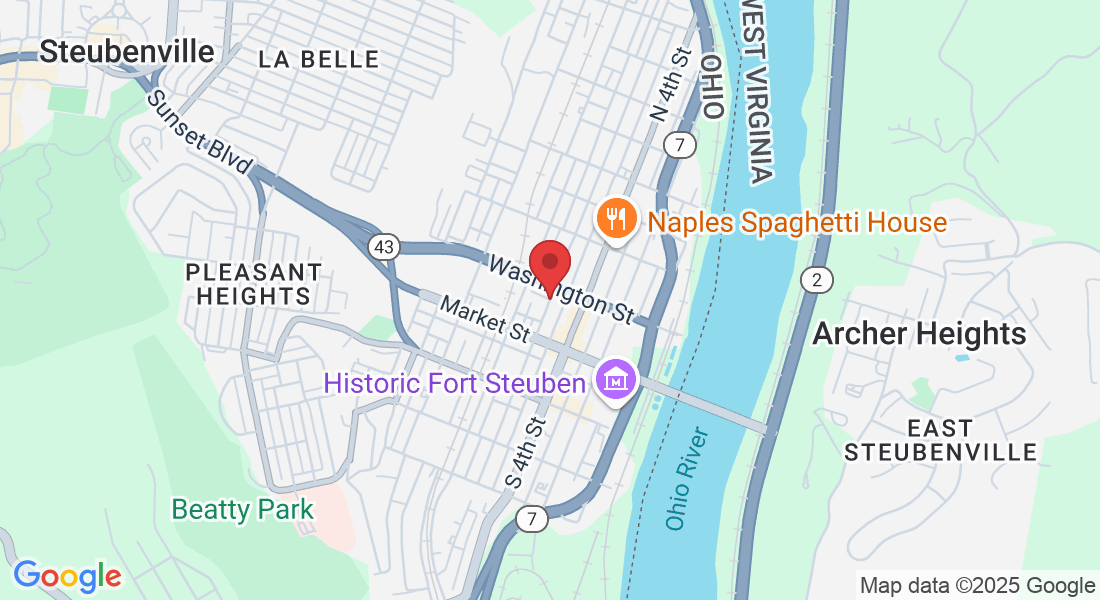

Tax Preparation and Planning

Bookkeeping

Financial Planning

Payroll Services

Turn Bookkeeping from a painful task into a powerhouse of data that can drive your business success. We take the time to sit down with you every month so we understand your business, and you understand your numbers.

Many tax strategies require setup, and months of proper implementation. Let us use our years of experience preparing taxes to build a plan so you can be proactive in your tax planning. We will save you time money every tax season.

Discover new ideas when you have the time and the right data. Bookkeeping done right is fuel for planning and growth.

Frequently Asked Questions

How does your service work? And how do I get started?

The first step is to book a free, no obligation discovery call so we can talk about your accounting needs, and how we can help. From there you can choose from a broad range of accounting services at competitive rates. Most commonly, small businesses hire us to work a few hours a week to keep their business finances current and compliant. This kind of outsourcing is an cost effective alternative to hiring a full time bookkeeper or accountant.

What are the differences between a bookkeeper, an accountant, and a CPA?

Bookkeepers, accountants, and certified public accountants (CPAs) all work with business finance and data. Bookkeepers record the company's transactions that include things like sales, payments, purchases, and expenditures. Accountants are able to provide data analysis of a company's performance, issue financial reports, and make recommendations. A CPA is an accountant that is licensed by the state.

For how long should I keep my tax records?

The IRS says you should keep tax records for 3 years from the date you filed your original return or 2 years from the date you paid the tax (whichever is later).

Testimonials

Testimonials

Herboth Business Solutions keeps my books organized and up to date, accounts for seeing to it my business retail taxes are currant, correct and paid on time, catches any mistakes from the financial perspective and comes to my place of business and save me time and much more. The results are correct and dependable

Cindy L

Jordan is friendly, helpful and professional. I would recommend him to anyone who is in need of accounting services such as bookkeeping, reporting, cashflow, and more! Jordan has been great both for my personal accounting and small business

Sarah M